Living in the U.S., having a solid credit history is very important. Credit reports and scores are primarily generated by the three major credit reporting agencies: Equifax, Experian, and TransUnion, both can be accessed for free.

Where to grab Your Free Credit Report

There are three major credit reporting agencies in America: Equifax, Experian, and TransUnion. The official site to fetch a free credit report is www.annualcreditreport.com. It says “annual credit report,” because federal law mandates that consumers can pull a free report from each agency annually, and this is the government-sanctioned site for it.

Since the onset of the Covid pandemic, to help consumers better navigate their financial waters, these three big agencies announced they’d provide a free credit report weekly. Initially, this was a temporary offering, but come September 2023, they jointly declared that this initiative “has been permanently extended.”

When these major credit agencies began their weekly report offering during the pandemic, someone snagged the domain weeklycreditreport.com in June 2021. It’s currently dormant. Makes one wonder if they might purchase and kickstart this domain in the future, right?

If you want to take a look at your credit report, head over to www.annualcreditreport.com. Provide your personal details like name, social security number, current address (and previous one if you’ve been at your current one for less than two years), zip code, mobile number (you might need to verify via text), and email. You can then peruse the credit reports from TransUnion, Equifax, and Experian.

I just took a peek at my TransUnion report. They required the ZIP + 4 code, something like 21005-5483. Normally, for mailing, shopping, or credit card applications, we just toss out the first 5 digits, which most folks remember. The last 4, not so much since they’re rarely used. But don’t sweat it — hop on over to this page on U.S. Postal Services’ website, key in your address, and you can fetch that 9-digit zip code.

Credit reports are chock-full of details. Skimming through mine, I saw comprehensive personal data: companies I worked at, job titles, old phone numbers, past apartment addresses, and so on. Then there’s credit account history: credit cards, mortgages, auto loans. Also listed are credit inquiries made by banks and financial institutions for promotional purposes (these are soft pulls, which don’t dent your score and don’t require your nod; but if it’s a hard pull that can affect the score, they need your green light).

Where to check my credit scores for free?

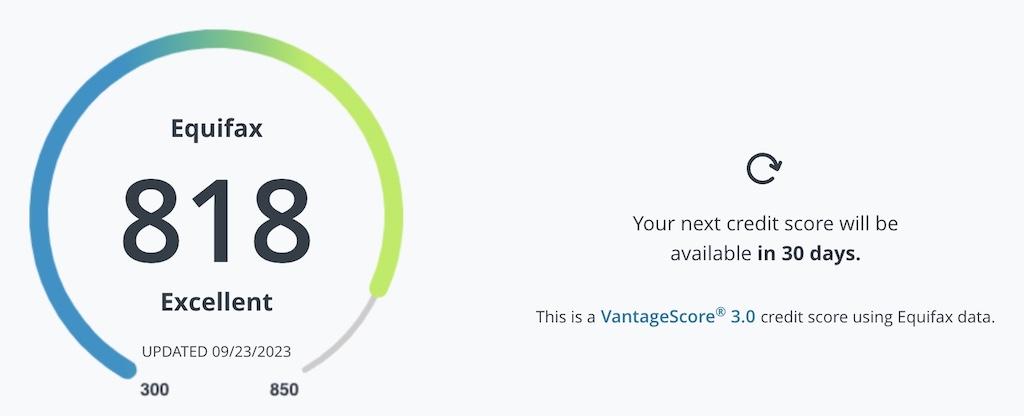

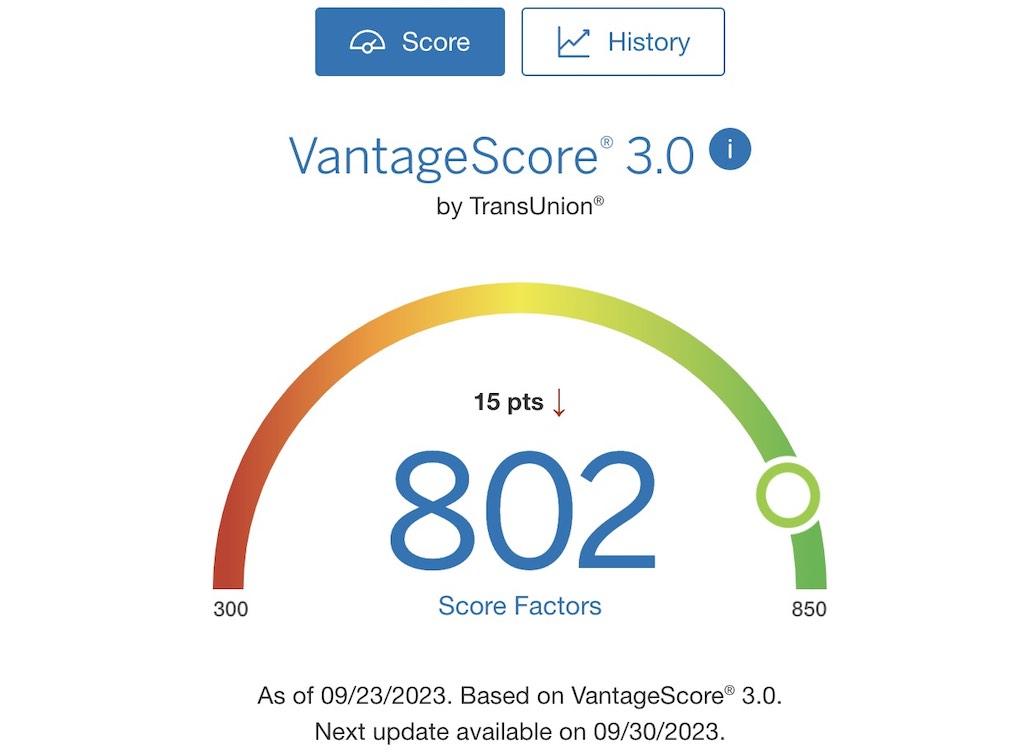

Equifax offers their score for free. Just sign up for a free account on their website, no credit card info needed. They use the VantageScore 3.0 model, and it’s updated every 30 days.

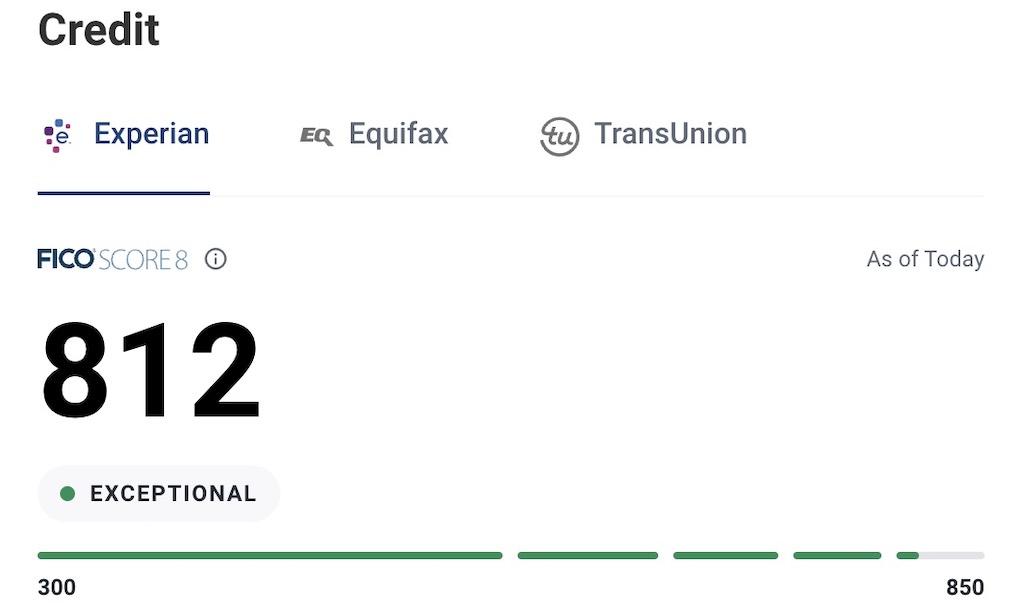

Experian also offers their score for free. They utilize the FICO SCORE 8 model. You can sign up for free, with no need to provide credit card details. If you want to view scores from Equifax and TransUnion as well, you’ll need to upgrade to the Experian CreditWorks Premium account, which offers a 7-day free trial, and afterward, it’s $24.99/month.

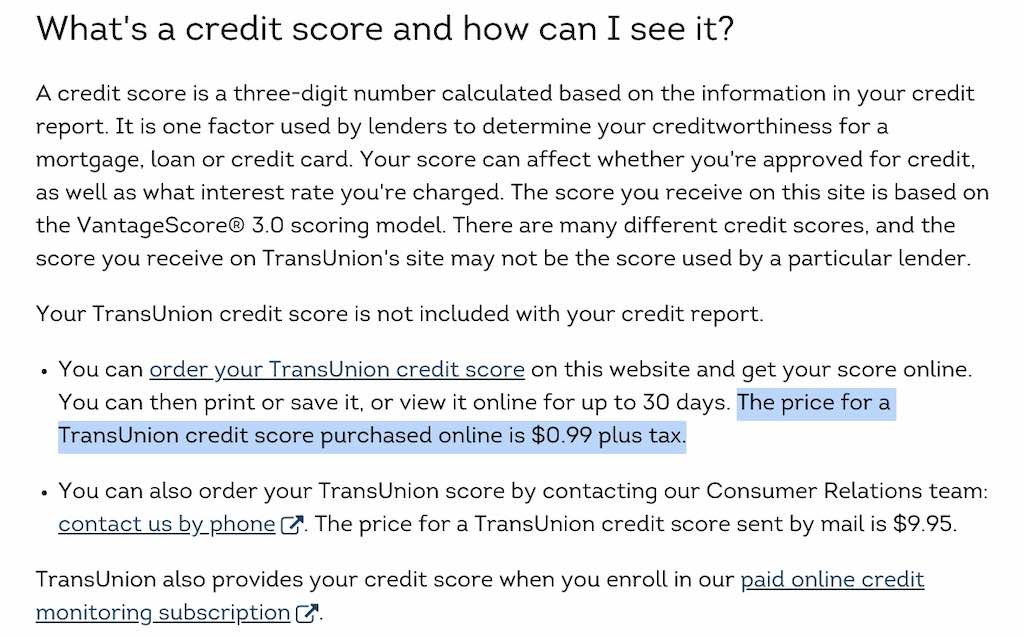

TransUnion doesn’t offer credit scores for free. A one-time pull costs $0.99.

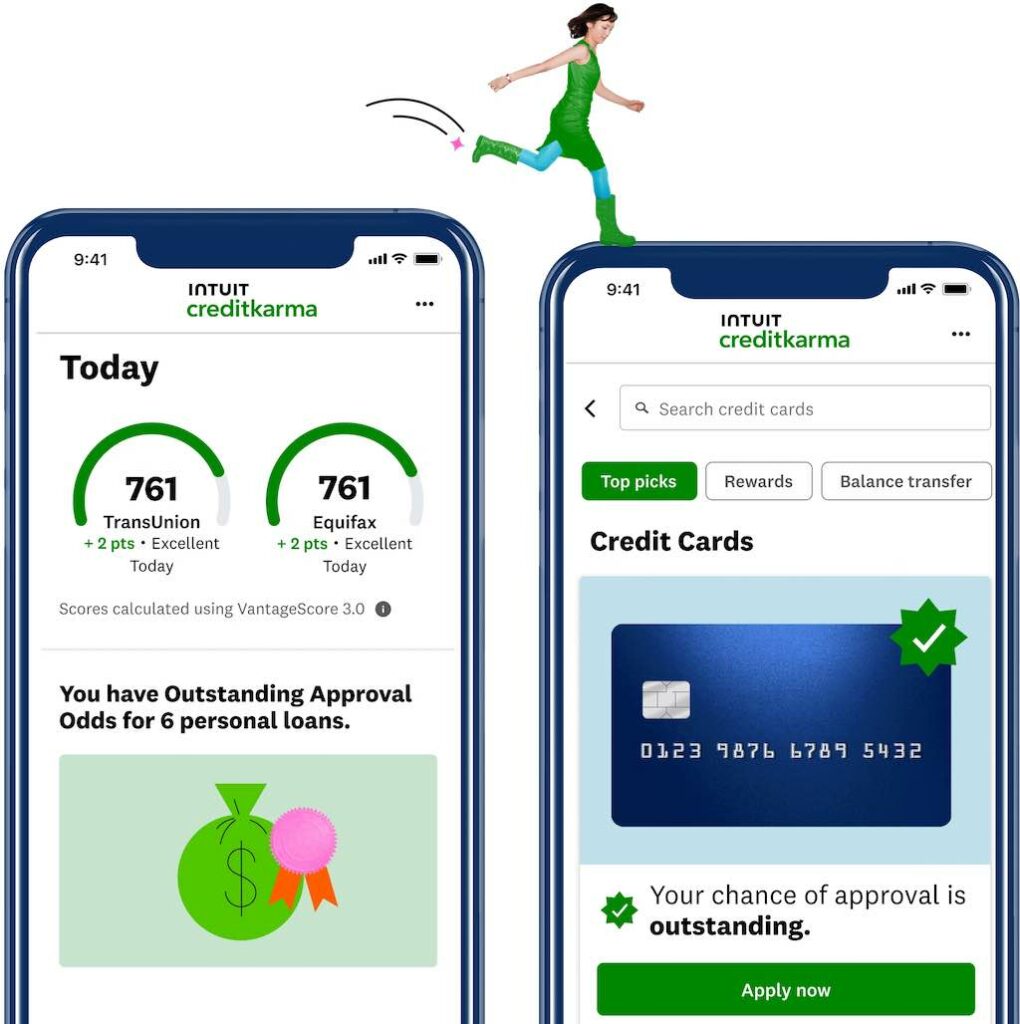

There are many other websites who provide free credit scores and credit summaries (essentially a simplified version of a credit report), such as Credit Karma , CreditSesame , NerdWallet , FreeCreditScore.com , Mint .

These platforms mainly monetize by recommending various financial products to you – for instance, after checking your credit score, they might suggest different credit cards for you to apply for.

Many credit card accounts also offer free credit scores. For example, American Express provides a TransUnion credit score using the VantageScore 3.0 model. Chase credit cards, on the other hand, offer Experian’s credit score, also based on the VantageScore 3.0 model.

Which score is used for mortgages and auto loans?

Unfortunately, whether it’s platforms like Credit Karma, Credit Sesame, or scores provided by credit companies like Chase or American Express, they often aren’t the scores used by mortgage and auto loan companies – they typically utilize a specific FICO score model.

In 1956, engineer William Fair from Stanford Research Institute and mathematician Earl Isaac founded a company to develop a credit rating system. The company was named after their founders: Fair, Isaac and Company. It was later renamed Fair Isaac Corporation, commonly known as FICO. The often-mentioned “FICO score” refers to the credit scores calculated using FICO company models from the three major credit bureaus.

Equifax, Experian, and TransUnion each have corresponding FICO scores. Additionally, FICO has multiple scoring models, and different financial institutions often use different versions, typically not the most recent ones. Here are the FICO scores and models frequently utilized by mortgage, auto loan, and credit card companies:

Common FICO score versions and their applications:

| Experian | Equifax | TransUnion |

|---|---|---|

| Mortgage | ||

| FICO Score 2 | FICO Score 5 | FICO Score 4 |

| Auto loans | ||

| FICO Auto Score 8 FICO Auto Score 2 | FICO Auto Score 8 FICO Auto Score 5 | FICO Auto Score 8 FICO Auto Score 4 |

| Credit card companies | ||

| FICO Bankcard Score 8 FICO Score 3 FICO Bankcard Score 2 | FICO Bankcard Score 8 FICO Bankcard Score 5 | FICO Bankcard Score 8 FICO Bankcard Score 4 |

| The most widely used model (meaning many platforms offer it for free) | ||

| FICO Score 8 | FICO Score 8 | FICO Score 8 |

| Other newer models | ||

| FICO Score 9 FICO Auto Score 9 FICO Bankcard Score 9 | FICO Score 9 FICO Auto Score 9 FICO Bankcard Score 9 | FICO Score 9 FICO Auto Score 9 |

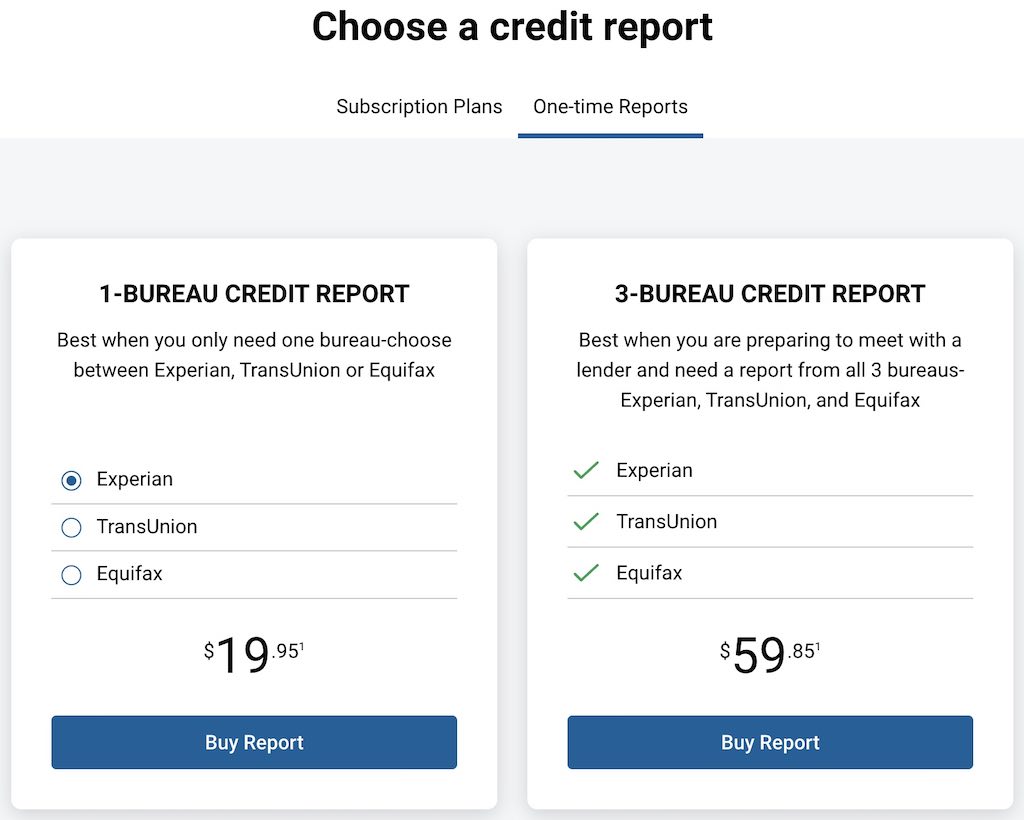

All the free scores are merely for reference. If you want to know the credit scores that mortgage and auto loan lenders will use, you either have to go through a pre-approval process (which is a hard pull and can lower your credit score) or purchase a report from FICO: $19.95 for one credit bureau or $59.85 for all three. Monthly subscriptions start at $19.95.

Mortgage companies typically pull FICO scores from all three major bureaus, discarding the highest and lowest scores and using the middle one. If a couple is applying together, they’ll use the lower of the two middle scores. At least that what they did and told me when I got my mortgage approved years ago.

So, does this mean that free credit scores are meaningless? Not exactly, because:

- While FICO’s various models aren’t identical, their foundational principles are similar. If you have a long credit history, a good repayment record, steady income, and low debts, you’re deemed a low lending risk and will have a high score. Conversely, if these factors aren’t in your favor, your score will be lower. Thus, these free credit scores are still very useful as a reference — if your scores from Credit Karma, Credit Sesame, Amex and Chase are consistently above 740, they likely provide an accurate reflection of your creditworthiness.

- Monitoring your free credit scores and their changes can help you catch errors and prevent issues. Many free monitoring tools also offer complimentary credit analysis and report summaries, helping you understand any weaknesses in your credit profile so you can address them. If there are mistakes in your credit report summary, such as recent hard inquiries when you haven’t applied for loans or credit cards, you can promptly contact the credit bureau to rectify them.

Disclosure: We are an Amazon Associate. Some links on this website are affiliate links, which means we may earn a commission or receive a referral fee when you sign up or make a purchase through those links.

Leave a Reply