When you hear the word “trust,” do you immediately associate it with terms like “wealthy people,” “tax avoidance,” or “asset protection”? Well, you’re not entirely wrong. A trust is, at its core, a three-party agreement. The first party, known as the trustor or settlor, places assets into the trust. These are managed by the second party, the trustee, for the ultimate benefit of the third party, the beneficiary.

The primary reason for setting up a trust is to provide legal protection for your assets, ensuring they are distributed according to your wishes. Trusts can save you time, reduce paperwork, and, in certain situations, help you minimize or even avoid estate taxes. Here, “estate taxes” refers specifically to federal estate taxes; individual states may have their own separate regulations.

4 Reasons Why You Should Set Up a Living Trust

Even if you have a will, your assets must go through probate—a court-supervised process—before they can be distributed to your heirs. This process can take months. However, if you set up a living trust while you’re still alive, the assets in that trust can bypass probate, allowing your beneficiaries to access them much more quickly.

In the case of an irrevocable trust, the assets you transfer into the trust are no longer considered your property, which means they aren’t subject to estate taxes. It’s worth noting, though, that the estate tax exemption in the U.S. is fairly high. For 2023, estate taxes won’t affect you unless your assets exceed $12.9 million. Tax rates for amounts above that threshold range from 18% to 40%.

If you don’t possess substantial wealth, then the “estate tax avoidance” benefit may not be applicable to you. However, don’t worry; trusts offer other advantages that people with more modest means can also enjoy:

- Control Your Wealth: With a trust, you can specify terms that dictate when and to whom your assets will be distributed. For example, you can set up a revocable trust, which allows you to use the assets while you’re still alive and specify who receives what after your passing. This is especially helpful if you’ve been married multiple times or have children from different marriages.

- Protect Your Legacy: A well-structured trust can shield your assets from being claimed by creditors of your heirs, squandered by financially irresponsible family members, or targeted by someone seeking to marry into your wealth.

- Privacy: Probate is a public process that can last for months, during which all your assets are publicly disclosed—your properties, shares, and more. If familial disputes or unexpected complications arise, assets can even be temporarily frozen. Trusts allow for the confidential transfer of assets outside of probate, potentially saving you money on court fees and taxes in the process.

- Wealth Continuation: Assets held in a trust can be professionally managed and invested to grow over time. In the event of an economic downturn, beneficiaries can utilize the trust’s assets to weather the storm.

One downside to consider is that trusts take time and money to establish. Moreover, once they’re set up, altering or dissolving them can be difficult or even impossible.

11 Common Types of Trusts

While there are many different types of trusts available, most fall into one or more of these primary categories. For more specialized options, it’s advisable to consult an estate planning attorney who can tailor a plan specifically for you.

1. Revocable/Living Trust

A revocable trust allows you to make changes or even dissolve it entirely while you’re still alive. Generally, it becomes irrevocable upon your death.

A living trust is established while you’re still alive and well. You retain full control over its assets and can appoint a successor to take over in case you die or become incapacitated.

To clarify, a living trust is a type of revocable trust. You can serve as the grantor, trustee, and beneficiary, or these roles can be filled by different individuals. The assets remain under your control, so this type of trust won’t help you avoid estate taxes or creditors.

2. Irrevocable Trust

Once an irrevocable trust is set up, you generally can’t change it without the beneficiary’s consent. You also relinquish control over the assets placed in the trust. On the upside, these assets won’t be subject to estate taxes.

3. Testamentary Trust

This trust is crated through a will, meaning the assets within it must go through probate and are subject to estate taxes.

4. Credit Shelter Trust

Also known as a bypass or “B” trust, this is another type of irrevocable trust. It allows one spouse to leave up to the estate tax filing threshold (refer to the chart above) to the trust. Assets in this trust will never be subject to estate taxes, even if they appreciate in value.

5. Marital Trust

Sometimes called a surviving spouse or “A” trust, this trust holds assets for the surviving spouse to use. It’s usually a revocable trust activated when the first spouse passes away. Profits generated from these assets benefit the surviving spouse, who may also access the principal under certain conditions. When the second spouse dies, the assets are transferred to designated heirs, taxes included.

6. Generation-Skipping Trust

This trust enables you to pass assets to beneficiaries who are at least two generations younger than you, typically grandchildren, but they don’t have to be related by blood. There’s a generation-skipping tax with its own exemption limit, which aligns with the estate tax filing threshold—$12.9 million for 2023. Amounts exceeding this limit are taxed at a flat rate of 40%.

7. Irrevocable Life Insurance Trust (ILIT)

This trust holds a life insurance policy as its sole asset. Once you place the policy into the trust, you relinquish ownership. Upon your death, the trustee manages the payout on behalf of the beneficiaries. The advantage? The insurance payout isn’t included in your taxable estate, thus avoiding estate taxes.

8. Qualified Terminable Interest Property Trust (QTIP)

This irrevocable trust allows you to allocate assets to specific beneficiaries at different times. The income from the trust is directed to the surviving spouse, while the principal remains in the trust. When the surviving spouse passes away, the principal goes to previously designated beneficiaries. This arrangement is particularly useful in situations involving multiple marriages, as it helps you distribute assets to children from prior relationships.

9. Charitable Trust

Often established as part of an estate plan, a charitable trust can help you minimize or avoid estate and gift taxes. There are two main types: Charitable Lead Trust and Charitable Remainder Trust.

In a Charitable Lead Trust, a portion of the assets is donated to a charity, with the remainder going to other beneficiaries. A Charitable Remainder Trust reverses this: a sum is withdrawn from the trust to benefit other beneficiaries for a specific period, after which the remaining assets are donated to charity.

10. Special Needs Trust

Ideal for dependents receiving government benefits like Social Security Disability, this trust allows for supplemental income without jeopardizing those benefits. For example, if you have a child with a long-term illness who is unable to care for themselves, this trust enables them to maintain state-provided healthcare while using trust funds for other daily necessities.

11. Totten Trust

Also known as a “payable-on-death account,” you can establish and fund this account while you’re alive. You serve as both the grantor and trustee, usually of a bank account (real property like homes is generally not included). When you die, the beneficiary receives whatever funds or securities are in the account. It’s a revocable trust, so it neither exempts you from estate taxes nor offers protection from creditors.

One major benefit of a Totten Trust is that its assets can bypass probate. Often referred to as a “poor man’s trust,” it requires no formal paperwork and is generally free to set up. Specific wording in the account title, such as “In Trust For,” “Payable on Death To,” or “As Trustee For,” can be used to establish this type of trust.

5 Steps to Set Up a Living Trust

1. Decide on the Type of Trust

If you’re a couple, you could opt for a joint trust, giving both partners control over the trust, or go for individual trusts based on your specific circumstances, especially if one partner doesn’t want the other controlling their assets, or if you’re looking to manage assets that predate your marriage.

2. Choose a Trustee

Once you’ve decided to set up a trust, you—the grantor—must choose a reliable trustee. This could be a spouse, relative, friend, attorney, or a specialized trust company. Some types of trusts allow you to be your own trustee, but you would also need to name a successor trustee to manage the trust upon your death.

3. Draft the Trust Agreement

This document will outline how you want your assets distributed, the terms for distribution, how these assets will be managed, and who the beneficiaries are. You can consult with estate planning lawyers and accountants to discuss the tax implications of various drafting options. Alternatively, online platforms and software can be used to draft trusts, particularly when your family situation is relatively straightforward.

4. Notarize the Document

You’ll need to sign the document in front of a notary. Due to the pandemic, some states have relaxed the “in-person” requirement, allowing for remote online notarization as long as the notary can verify your identity through video. Rules vary by state, so consult a lawyer (usually for a fee) or your local secretary of state’s office if you’re unsure. In most states, notaries are overseen by the secretary of state’s office.

5. Open a Trust Bank Account and Fund It

At this stage, you can start transferring funds into a specialized bank account set up for the trust, known as a Trust Checking Account. Alternatively, you can change your existing bank accounts to trust accounts. The account is held in the name of the trust and is managed by the trustee. As a bank deposit account, it is insured by the Federal Deposit Insurance Corporation (FDIC).

The amount of FDIC insurance depends on the type of trust, the number of beneficiaries, and their individual status. For revocable trusts, while the grantor is alive, the FDIC coverage limit is $250,000. After the grantor’s death, each beneficiary is considered an individual owner, so each can get up to $250,000 of protection. For irrevocable trusts, the coverage is $250,000 for the duration of the grantor’s lifetime.

4 Tools to Help You DIY a Living Trust

1. LegalZoom

LegalZoom offers online living trust services, with prices starting from $279. The most basic DIY package does not offer legal assistance. The grantor can fill in details about their assets, distribution methods, and beneficiaries through a Q&A system, and the website will generate the official trust documents. The basic package can be modified at will within 30 days. For an additional $20-$30, legal assistance is available. Full refunds are offered within 60 days if the customer is not satisfied.

| Do It Yourself Basic Living Trust | Lawyer Assistance Comprehensive Living Trust | Lawyer Assistance Estate Planning Package |

|---|---|---|

| $279 | $299 | $399 |

| Online form-filling, customized living trust | Customized living trust + legal advice within 2 weeks | Three estate planning documents (including living trust) + 1 year of legal advice |

| Living Trust | Living Trust | Living Trust Financial Power of Attorney Living Will |

| Online form-filling | Free legal questions for 2 weeks, then $25/month (cancel anytime) | Free legal questions for 1 year, then $199/year (cancel anytime) |

| Unlimited modifications within 30 days | Reviewed by a lawyer | Reviewed by a lawyer |

2. Trust & Will

Trust & Will allows you to create trusts and wills online. Their fintech experts offer state-specific living wills and revocable living trusts, which can help your family avoid the cumbersome probate process, designate guardians for your minor children, and outline your wishes for emergency medical situations. Individual trusts cost $599, and spousal trusts cost $699. Trust & Will provides one free complete document mailing and unlimited modifications within a year. The documents include the trust agreement, asset list, last will and testament, living will, HIPAA authorization, POA, and notary certificate.

3. Rocket Lawyer

Established in 2008, Rocket Lawyer provides online legal services, including documents and lawyer assistance. Users can purchase individual legal documents like wills, living trusts, and power of attorney forms for $39.99 each. After filling out all the required information online, you can immediately download them and receive guidelines on how to make them legally binding. Your documents can be securely signed online, and you can also invite others to digitally sign them. This allows for quick updates and changes.

Being a Rocket Lawyer member is quite economical at $39.99/month, with a 7-day free trial for new users. At this price, you get unlimited access to all their legal documents (and updates) and lawyer services, including a free 30-minute consultation on new legal issues. You can use their online “Ask a Lawyer” service for legal queries, and you may get discounts if you hire a lawyer through Rocket Lawyer. You can also contact customer service via email, online chat, or their hotline.

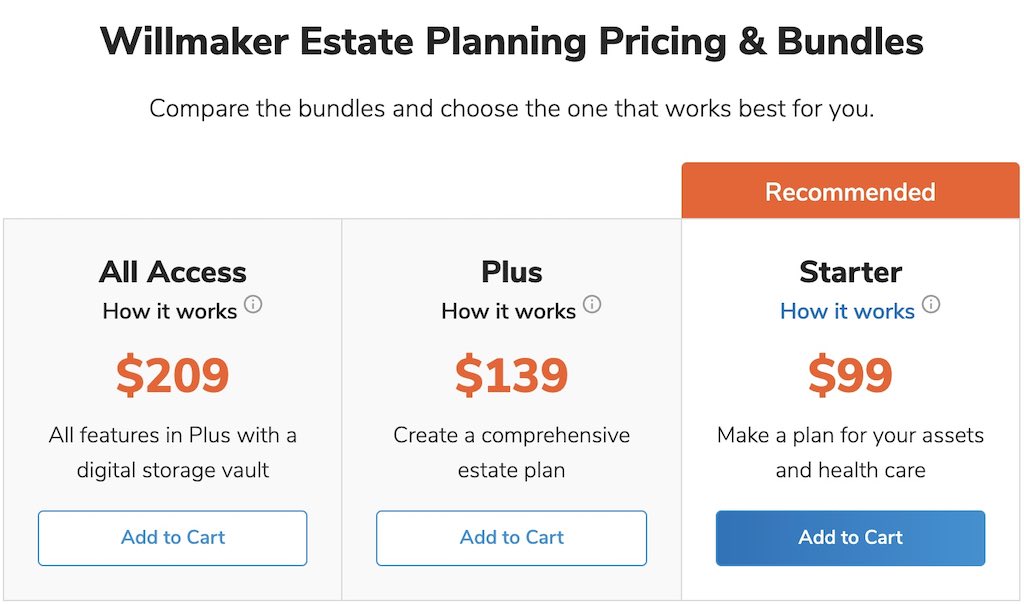

4. Quicken WillMaker

Quicken WillMaker & Trust is a DIY will and trust software developed by 50-year-old legal publisher Nolo. There are three packages available, priced from $99 to $209; not applicable in Louisiana. The mid-priced package at $139 includes a will, advanced medical directive, funeral arrangements, living trust, and POA. The website occasionally offers a 25%-30% discount, so keep an eye on the pop-up windows.

The software is compatible with both Mac and Windows and is easy to use. Custom legal documents can be created via simple questionnaire forms. You can then save the information and download the complete documents in PDF format. You can update at any time for free within the first year after purchasing the software, after which you have to pay for updates.

Conclusion

In the United States, trusts are not exclusive to the wealthy. Even if you only have a house worth a few hundred thousand dollars, you might consider setting up a trust. Using a will to transfer property involves a cumbersome court probate process, consuming both time and money.

If your family structure is simple, without the complexities of multiple marriages and disputes over inheritance, then using a trust to leave property to your children may be a simpler, more time-efficient method. There are significant differences in trust laws between states, so consult a specialized estate planning lawyer before making any decisions.

Disclosure: We are an Amazon Associate. Some links on this website are affiliate links, which means we may earn a commission or receive a referral fee when you sign up or make a purchase through those links.

Leave a Reply